By Keith Gangl

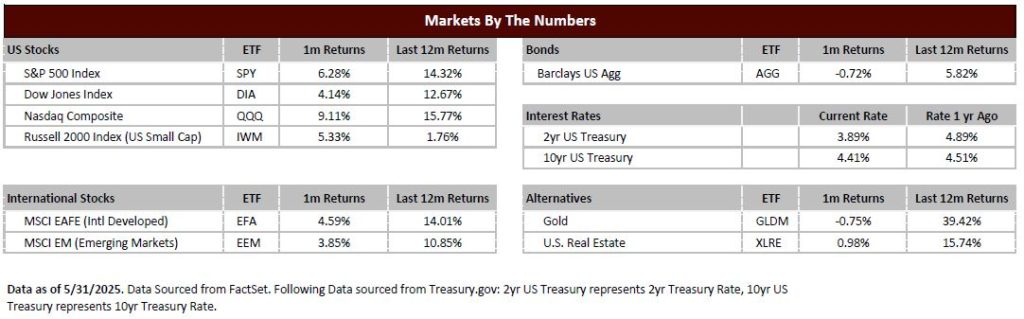

Following a volatile April, May delivered a remarkable turnaround with normalized volatility and impressive stock market returns. The Wall Street adage of “sell in May and go away” certainly proved false this year, as the S&P 500 surged more than 6% during the month, the biggest May gain since 1990 and the largest monthly return since November 2023.

The market’s spring journey began with significant selling pressure in March and early April, driven by investor concerns over tariffs, economic health, and corporate earnings prospects. However, these worries gradually began to dissipate over the following weeks, setting the stage for May’s impressive rebound. While such concerns can always resurface, recent data suggests the improvement trend may continue.

A catalyst for much of May’s optimism came from first quarter earnings reports, which exceeded expectations and addressed one of investors’ primary concerns. Perhaps more importantly, companies provided forward guidance, a development many had feared would be absent due to tariff uncertainties. This willingness to offer guidance, regardless of whether projections were raised, signaled management confidence in navigating the current environment.

May’s performance became even more impressive considering the backdrop of potentially market-moving events, including a Moody’s US debt downgrade, ongoing trade war developments, and the House passage of a comprehensive budget bill (“one big beautiful bill”). Despite these headline risks, the underlying strength of the US consumer continued to drive economic momentum forward.

The current investment landscape presents a particularly daunting ‘wall of worry,’ headlined by the largest tariff increases in a century and growing questions about US economic exceptionalism. Adding to this uncertainty are the rapidly evolving policy changes from Washington, which remain difficult to predict. Yet markets not only absorbed these concerns but climbed significantly higher throughout May.

As summer approaches, several critical factors will likely shape investor sentiment and market positioning. The resolution of tariff policies stands as the primary catalyst, with courts ultimately determining their future implementation. The sustainability of the positive earnings trend represents another crucial variable—can companies maintain their better-than-expected performance? Finally, inflation monitoring will remain paramount, as investors assess whether price pressures might once again constrain economic growth.

Looking ahead, May’s remarkable performance serves as a powerful reminder that markets often surprise even the most seasoned observers. While the ‘wall of worry’ remains formidable with ongoing policy uncertainties and economic headwinds, the market’s ability to digest negative news and focus on fundamental improvements in corporate earnings demonstrates the underlying strength of American businesses and consumer resilience.

Investors who maintained their discipline through the turbulent spring months were rewarded handsomely, reinforcing the timeless investment principle that staying the course during periods of uncertainty often proves more profitable than attempting to time the market. As we enter the traditionally quieter summer months, May’s lesson is clear: in a market built on optimism and innovation, rebounds can be swift and substantial for those patient enough to weather the storms.