By Keith Gangl

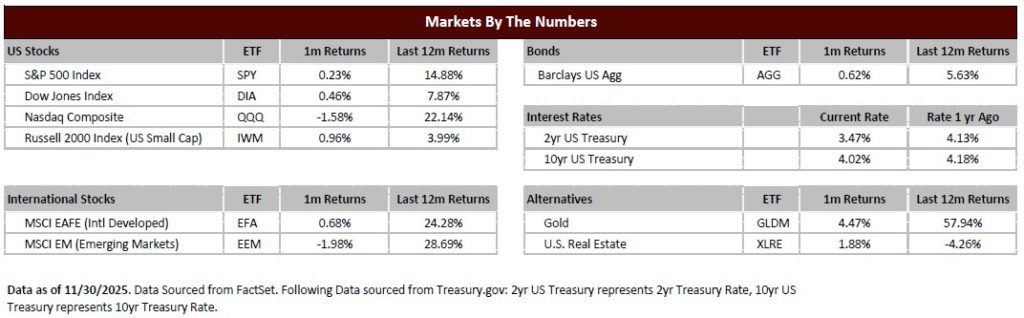

October is known for volatility, but this year that wasn’t the case, as turbulence seems to have shifted into November. The stock market managed to sidestep the historically volatile month of October, only to see significant swings emerge in the following month. As measured by the S&P 500, the market managed a slight increase for November, marking seven consecutive months of gains and bringing the year-to-date performance to over 16%.

At first glance, November’s monthly stock market performance appeared normal, a mild month, with a modest positive return. However, what occurred beneath the surface was anything but mild. Stock market volatility returned with a vengeance as the market experienced significant swings throughout the month. After falling nearly 5% at one point in November, a late-month rally pushed returns back into positive territory.

Several factors may have contributed to November’s heightened volatility, including uncertainty around the Federal Reserve’s interest rate policy and growing questions about the sustainability of the artificial intelligence (AI) investment wave.

The Fed has been lowering the federal funds rate recently, and investors are trying to determine whether this path will continue or pause. In general, investors prefer lower rates, which tend to stimulate economic growth. However, cutting rates too quickly could reignite inflation, something neither the Fed nor investors want to see. Typically, Fed Chairman Jerome Powell clearly communicates expectations for future interest rate policy at FOMC meetings, but at the last meeting, he stated that a further reduction at the Dec. 18 meeting was “not a foregone conclusion.” This uncertainty caused the probability of a rate cut to plummet from 75% to 30%, though it has since rebounded to over 80%. Such dramatic swings in market expectations are highly unusual and have contributed significantly to market volatility.

Another factor fueling November’s turbulence is mounting pressure on the AI investment theme. Investors have begun questioning both the sustainability of massive AI spending and future profitability prospects. The enormous capital being poured into AI infrastructure is starting to show cracks, prompting concerns about whether productivity gains will justify the investment and whether the current hype will translate into actual profits. Adding to investor unease is the fact that some companies are taking on debt to fund their AI infrastructure initiatives, raising questions about financial risk and return on investment.

As we close out November and look toward December, the stock market faces a critical juncture. The Fed’s upcoming decision on interest rates and the ongoing evaluation of AI investments will likely continue to shape market dynamics in the months ahead. While volatility can be unsettling for investors, it also reflects the market’s process of digesting new information and recalibrating expectations. The key for investors will be maintaining perspective, focusing on long-term fundamentals, and recognizing that short-term turbulence, while uncomfortable, is a normal part of market cycles. Whether the traditional “Santa Claus rally” materializes in December or volatility persists remains to be seen, but one thing is certain: the market’s ability to digest uncertainty and adapt to changing conditions continues to demonstrate its resilience.