By Tyler Ellegard

In financial markets, a variety of well-known aphorisms often guide investor behavior — phrases such as “So goes January, so goes the year,” “Buy low, sell high,” and “Sell in May and go away.” One of the most relevant in the current environment, however, is “Don’t fight the Fed.” This adage underscores the importance of aligning investment strategies with the policy stance of the U.S. Federal Reserve. Whether the Fed is raising or lowering its benchmark interest rate, the direction of monetary policy has a profound impact on asset pricing, market sentiment, and portfolio positioning.

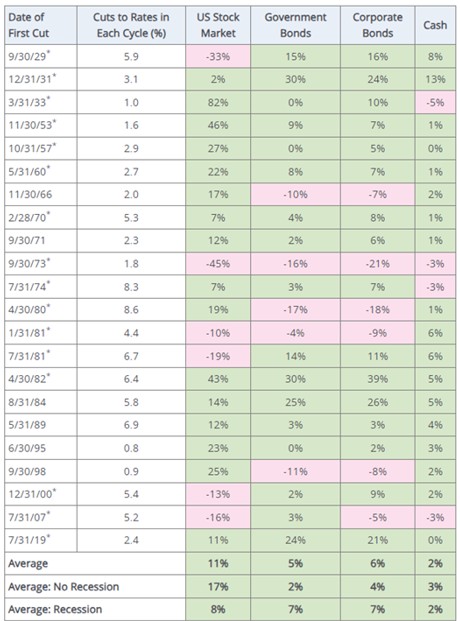

Over time, monetary policy has consistently demonstrated its ability to shape market trajectories. In the early 1980s, Paul Volcker’s aggressive rate hikes ultimately broke the back of inflation but triggered significant volatility for both equities and bonds. Conversely, the post-2008 era of near-zero interest rates and quantitative easing fueled one of the longest bull markets in history by lowering the cost of capital and supporting risk assets such as the stock market. The chart below shows performance 12 months after the first rate cut for the S&P 500 (US Stock Market) and different bond types.1

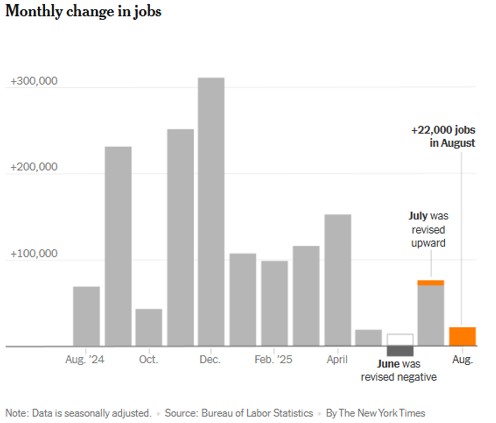

In the current environment, weaker economic data can paradoxically be viewed as positive for equities. While it may seem counterintuitive, signs of a slowing economy often create room for the Federal Reserve to lower its benchmark interest rate, thereby reducing borrowing costs and improving liquidity conditions for corporations. For investors, it is important to distinguish between an outright economic contraction and a gradual moderation in growth. As illustrated in the chart below, the US continues to generate new jobs, though at a slower pace than in prior periods — a dynamic that signals softening rather than broad deterioration.2

Ultimately, this reinforces the importance of not fighting the Fed, as market performance continues to hinge on the direction of monetary policy rather than economic data in isolation.

For investors, the lesson is clear: monetary policy remains a powerful force shaping market direction. While the maxim “don’t fight the Fed” provides valuable perspective, it should not serve as the sole guide for portfolio positioning. Instead, it is best considered alongside a broader set of economic indicators, corporate fundamentals, and valuation opportunities. By integrating the Fed’s trajectory with these additional data points, investors can build more balanced portfolios that are responsive to both policy dynamics and underlying market fundamentals.

1. https://bluerockwealth.com/blogs/perspectives/dont-fight-the-fed

2. https://www.nytimes.com/live/2025/09/05/business/jobs-report-august-economy