By Kyle Bergacker, CFA®

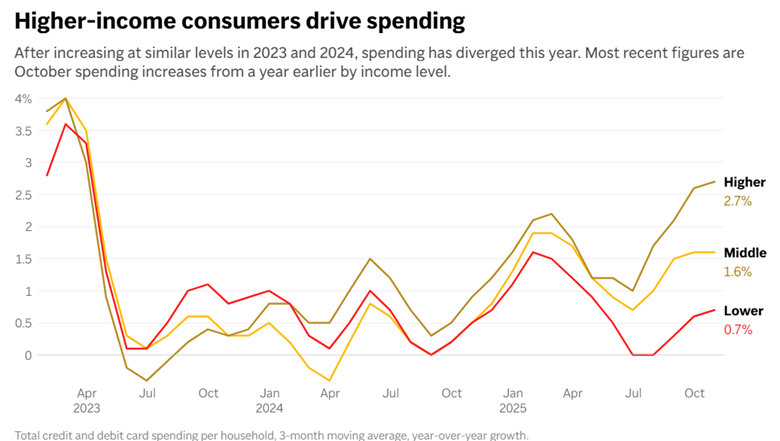

The US consumer remains central to economic momentum, yet the picture today is more complicated than a single data point or trend can capture. While overall spending continues to support growth, widening differences between higher- and lower-income households have created what many economists now call a “K-shaped” economy — where one segment continues to climb while another struggles to keep pace.

Several indicators highlight this divergence.

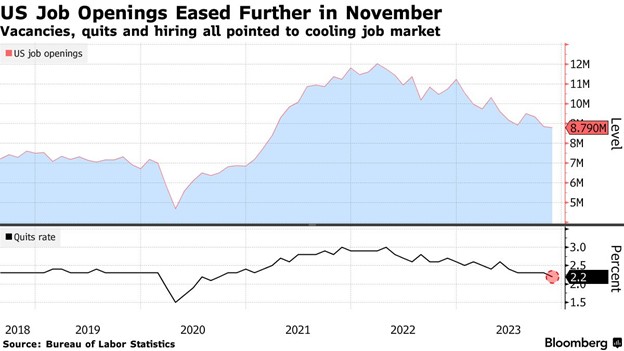

Labor market conditions continue to support consumer spending, but clearer signs of cooling have emerged. November’s JOLTS report showed job openings easing to 8.79 million, the lowest since early 2021, and hiring falling to its weakest level since April 2020. Layoffs remain low, yet fewer workers are voluntarily quitting, with the quits rate at a four-year low. The ratio of openings to unemployed workers held at 1.4, well below the 2-to-1 peak in 2022; however, more in line with historical norms. For the Federal Reserve, this moderation is likely welcome as it relieves wage pressure and supports the broader effort to contain inflation. Many employers who struggled to hire during the pandemic are now scaling back recruitment; not through job cuts, but through fewer openings. Overall, the labor market remains solid but is clearly losing momentum, especially in manufacturing, transportation, and leisure and hospitality.

Source: Federal Reserve Bank of Minneapolis

Meanwhile, spending trends increasingly depend on household balance sheets and income brackets. Higher-income households continue to spend at a healthy clip, supported by rising asset values and stable incomes. However, middle- and lower-income consumers are showing clear signs of pressure. Bank studies and government data highlight lagging spending growth for these groups, alongside rising credit card delinquency rates that have nearly returned to their long-term averages.

Source: Federal Reserve Bank of Minneapolis

Corporate earnings commentary reinforces this story. Walmart, Target, and a host of other consumer companies have noted a consumer who is more selective or “choiceful,” trading down into private-label goods and prioritizing essentials over discretionary purchases throughout the year. At the same time, Dollar General observed an unexpected trend in higher-income shoppers trading into dollar stores in search of value at the highest clip in years. This shift signals broadening price sensitivity across the consumer spectrum, not just among those already under financial strain.

The divide is also apparent in sectors tied to discretionary or premium spending. Airlines, for example, continue to see strong demand for premium cabins even as budget-conscious travelers cut back. Consumer goods companies discuss both “premiumization” for wealthier customers and “affordability strategies” aimed at households focused on stretching every dollar.

These trends reflect a broader macro environment characterized by solid top-line economic growth but uneven underlying experiences. Asset inflation, especially in equities, continues to benefit upper-income households disproportionately. Meanwhile, persistent inflation in housing, groceries, and imported goods places a heavier burden on middle- and lower-income families.

At Gradient Investments, we view the current consumer backdrop as stable but uneven. The upper branch of the “K” appears well-supported by balance sheet strength and continued job stability. The lower branch reflects fatigue, slower wage gains, and tighter financial conditions.

We believe this divergence will be a critical theme to watch in the coming year. A broadening economic slowdown could pressure the top of the K, while potential policy changes, tax refunds, or interest-rate adjustments may offer support to the bottom. As always, we will continue monitoring the data and corporate insights to assess whether consumer resilience can hold across all income groups…or whether the widening gap becomes a more meaningful headwind for economic growth in 2026.